WHY SOME PEOPLE THINK BANKS ARE MAKING TOO MUCH MONEY.

Having seen the devastation caused recently by SVB bank going to the wall and taking another with it, and then seeing Credit Suisse being baled out, it made me wonder what the banks are doing to ensure the safety of our – my money!!

As I progress, I’m becoming more and more disillusioned with the banking system and their capacity to allegedly look after MY MONEY.

Hence I have been looking closing at the new PLC Ultima coin and the strategy to mint from this

However, I’m not going to talk much about PLC Ultima, I want to talk about banks because I read this great article by Rob Stock on New Zealand banks. As you know I’m a proud Kiwi, but like the banks here, New Zealand banks seem to be making even more money from its clients.

So here’s the article: By the numbers: Why some people think banks are making too much money.

Are banks making too much money……?

Banks continue to make record profits while households like you and me, are experiencing enormous increases in their mortgage rates. The same as we are experiencing in Britain currently with the cost-of-living crisis going through the roof, and with so many people struggling.

So here are some of the numbers that explain why so many people are so angry with banks.

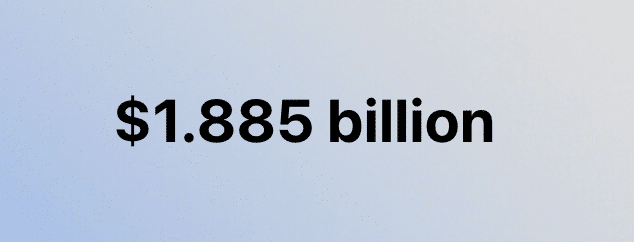

$1.885 billion

That’s the after-tax profits the banks in New Zealand made in the last three months of 2022.

They made $7.4b in after-tax profits in the whole of 2022.

That was the highest level of after-tax profits the banks have ever made. Part of the reason was because even as they were lifting home loan rates, they were also able to increase their margins.

2.37%

This was the net interest margin (NIM) that banks earnt on their loans in the last three months of 2022. The higher a bank’s NIM, the more it is earning from its loans after what it pays for funds is taken into account.

That 2.37% is the equal-highest margin that banks have earned since September 2005. Rising margins plus larger loan books mean shareholders get bigger profits.

7.84% vs 4.94%

Fat bank margins come as borrowers are having to swallow big increases in home loan rates. The average floating rate on a new home loan, when the borrower had less than 20% equity, was 7.84% at the end of February. A year ago, earlier, it was 4.94%. New Zealand are doing it harder than we are here.

The average one-year fixed rate on new home loans for these people had gone from 4.26% to 6.91%.

The average two-year fixed rate had gone from 4.75% to 7%.

Increases in home loan rates mean people refixing their loans face locking in much higher repayments.

$470 a fortnight

Someone outside Auckland who bought an average-priced house in 2020, and took out an 80% mortgage fixed for two years would see their minimum fortnightly payments rise by about $470 per fortnight, if they refixed now!

If that buyer were in Auckland and bought an average-priced house there, the increase in debt servicing costs would be $811 per fortnight.

$120 billion

A lot of homeowners face refixing at these higher rates. Reserve Bank data showed that in January, $120b of fixed-rate home loans, had less than a year until they would need to be refixed.

7.2%

All this is happening as households face enormous increases in the cost of living.

Just like here in Britain. The rate of inflation, as measured by the Consumer Price Index, hit 7.2% in September. We are slightly better off here.

18,400

This is the number of mortgage accounts on which borrowers were behind in their home loan repayments in January.

That’s still just 1.26% of home loans, but the trend is up. In December, 17,200 were behind in their home loan repayments. It’s shaping up for a tough year for homeowners.

What to do. These increases are worldwide, and continue to trend in the wrong direction for we consumers. The numbers make sobering reading. This is 1 reason I’m looking very closely at PLC Ultima and the benefits it can bring to me, my close friends and family.